Insights, Trends, and Innovations shaping the Production and Sustainability

A Guide to Chemical Mixing Scale Up! : From the Lab to the Factory

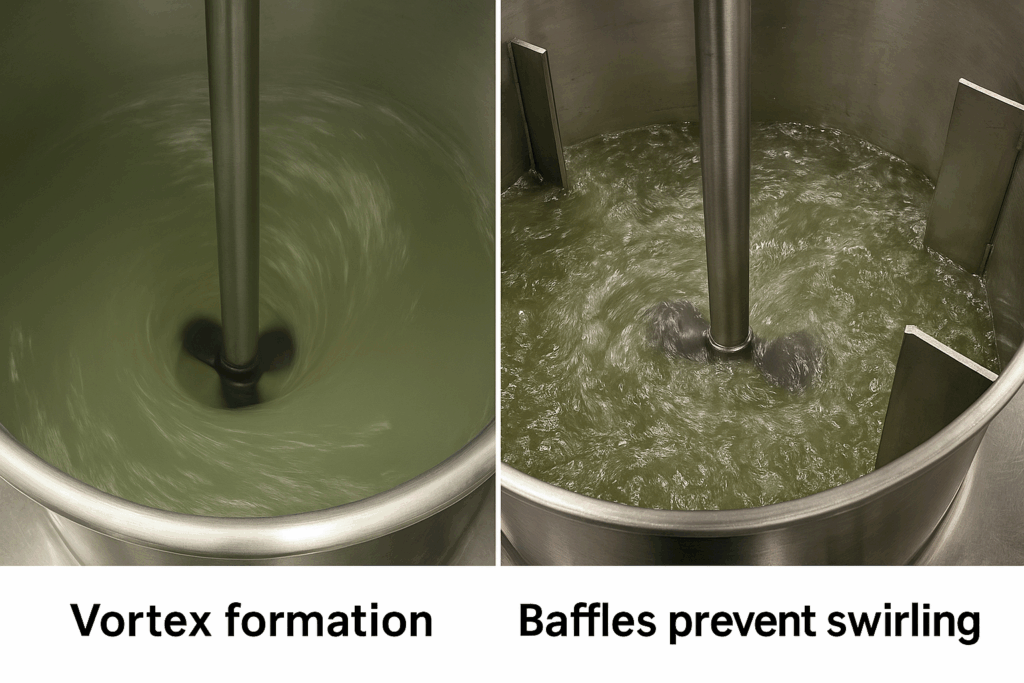

A Guide to Chemical Mixing Scale Up! : From the Lab to the Factory Understanding How Liquids Move While intense ...

🔒The New American Factory : Forged by Tariffs, Fueled by Robots, and Fought For by a New Workforce

The New American Factory : Forged by Tariffs, Fueled by Robots, and Fought For by a New Workforce Gemini Generated ...

Single Atom Thick Tin Sulfide : Big Potential from Simple Ingredients

Single Atom Thick Tin Sulfide : Big Potential from Simple Ingredients Imagine a material so thin it's only a single ...

The Definitive 2025 Guide to FMEA, Mastering Proactive Risk Management

The Definitive 2025 Guide to FMEA, Mastering Proactive Risk Management OpenAI, AI-generated image, DALL·E, https://labs.openai.com In a world of escalating ...